At Probashi Realty, we believe in making the real estate journey as smooth and accessible as possible for our clients. Getting started with us is a breeze, thanks to our user-friendly and intuitive processes. Whether you’re a first-time homebuyer, a seasoned investor, or a property seller, we’ve streamlined our procedures to eliminate complexities and minimize hassles.

To get started, simply reach out to our friendly team, and we’ll guide you through the initial steps with utmost care and efficiency. Our expert real estate professionals are readily available to understand your unique needs and goals, ensuring a tailored approach to your requirements. With a wealth of industry knowledge and the latest technology at our fingertips, we can swiftly pinpoint the best solutions for your real estate endeavors. At Probashi Realty, we believe that embarking on your property journey should be exciting and stress-free, and we’re here to make that a reality. Whether you’re seeking your dream home or looking to maximize your property’s value, we’re committed to making the process easy, enjoyable, and ultimately successful for you.

Here are some 25 valuable One-Point-to-Know tips for buyers in the real estate market:

Define Your Goals: Clearly outline your purpose for buying – whether it’s a home, an investment, or a vacation property.

Set a Budget: Determine your financial capacity and secure pre-approval for a mortgage to know your spending limits.

Location Research: Investigate neighborhoods thoroughly, considering factors like safety, amenities, schools, and proximity to work.

Property Type Match: Choose a property type that aligns with your needs and goals – single-family, condo, townhouse, etc.

Market Trends Study: Research local real estate trends to make informed decisions about when to buy.

Must-Have vs. Desirable Features: Prioritize essential features in a property while considering desirable but non-essential ones.

Property Visits: Attend open houses and schedule viewings to experience properties firsthand.

Inspection Significance: Conduct thorough property inspections to identify potential issues and ensure transparency.

Future Resale Consideration: Anticipate the property’s resale potential even if it doesn’t align with your long-term plans.

Local Zoning Awareness: Understand zoning laws and regulations that might affect property use and value.

Historical Research: Dig into a property’s history for insights into past sales, renovations, and legal matters.

Neighbor Insights: Engage with neighbors to gather valuable information about the property and the area.

Expense Calculations: Estimate all costs – property taxes, HOA fees, maintenance – to avoid budget surprises.

Professional Consultation: Seek guidance from real estate agents and experts to navigate the buying process.

Future Development Evaluation: Assess the potential for growth and new developments in the area.

Gut Instincts Matter: Listen to your intuition; if something feels off, it might be wise to reconsider.

Negotiation Preparedness: Be ready to negotiate confidently to secure favorable terms.

Legal Review: Involve legal professionals to ensure contracts and agreements protect your interests.

Hidden Gem Hunting: Look beyond apparent flaws – a less polished property might have untapped potential.

Noise and Traffic Analysis: Consider noise levels and traffic patterns, especially if you value a quiet environment.

Future Plans Alignment: Ensure the property aligns with your long-term plans and lifestyle aspirations.

Utilities and Infrastructure Check: Evaluate the availability and condition of utilities and infrastructure.

Offer Timing: Act promptly when you find the right property, as the market can change quickly.

Multiple Property Research: Explore multiple options to avoid making hasty decisions based on emotions.

Documentation Scrutiny: Thoroughly review all paperwork to prevent misunderstandings and ensure transparency.

These points offer a comprehensive guide for buyers entering the real estate market, helping them make informed decisions that align with their goals and needs.

Learn more about types of real estate:

Of course real estate encompasses a wide range of property types, each with its own characteristics, investment potential and considerations. Here are some common types of real estate:

Residential Properties:

- Single-Family Homes: These are standalone houses designed for a single family. They offer privacy and often come with a yard.

- Condominiums (Condos): Condos are units within larger buildings. Buyers own the individual unit and share ownership of common areas.

- Townhouses: Similar to condos, but townhouses are typically multi-story structures with shared walls and private entrances.

- Duplexes and Multi-Family Homes: These properties house multiple families in separate units. They can be an excellent investment, as you can live in one unit and rent out the others.

Commercial Properties:

- Office Buildings: These can vary from small office spaces to skyscrapers, catering to businesses of all sizes.

- Retail Spaces: This includes shopping centers, malls, and individual storefronts, which can offer stable rental income from retail businesses.

- Industrial Properties: Warehouses, manufacturing facilities, and distribution centers fall under this category. They can be lucrative due to their potential for long-term lease agreements.

- Hospitality Properties: Hotels, motels, and resorts cater to travelers and tourists. These properties can offer seasonal income fluctuations.

Special Purpose Properties:

- Educational Buildings: Schools, colleges, and training centers fall into this category.

- Healthcare Facilities: Hospitals, clinics, nursing homes, and medical offices are specialized properties.

- Religious Buildings: Churches, temples, mosques, and other religious institutions are unique properties with specific usage requirements.

Mixed-Use Properties:

- These properties combine different types of real estate within the same building or development. For instance, a building might have retail on the ground floor and apartments on the upper levels.

Vacant Land and Development Properties:

- Land without any structures can be purchased for development. This can range from building residential communities to commercial complexes.

Real Estate Investment Trusts (REITs):

- REITs are investment vehicles that allow individuals to invest in real estate without owning the physical properties. They provide an opportunity to invest in large-scale, income-producing real estate without directly managing it.

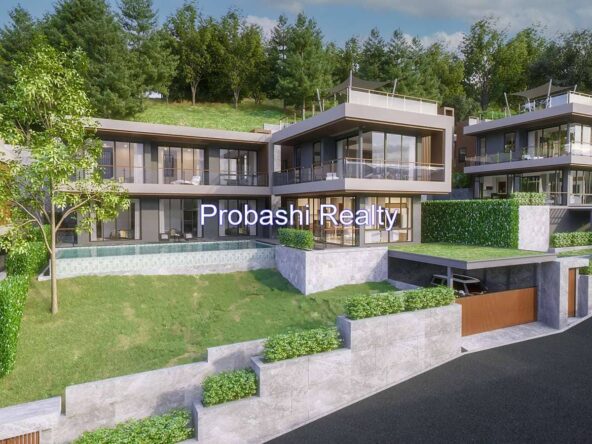

Luxury Properties:

- These properties cater to high-end buyers and often include features like premium locations, unique architectural designs, and extensive amenities.

Agricultural Properties:

- Land used for farming, ranching, or other agricultural purposes. These properties can offer investment opportunities related to agricultural activities.

Vacation Properties:

- Second homes or properties in popular vacation destinations. They can serve as personal getaways and potential rental income sources.

Remember that each type of property comes with its own set of considerations, risks, and potential rewards. When considering a real estate investment, it’s crucial to thoroughly research and understand the specifics of the property type and its market trends. Consulting with professionals like real estate agents, property managers, and financial advisors can help you make informed decisions based on your goals and risk tolerance.

Available For Sale

Semi-Detached Townhouse for sale at LaSalle, Montreal

- Beds: 3

- Baths: 2

- 2,200 Sq.Ft

- CAD $640,000

15,000 sqft Commercial/Office space rent in Brossard

- Bed: 0

- Bath: 1

- 15,000 Sq Ft

- CAD 19$ per Sq Ft

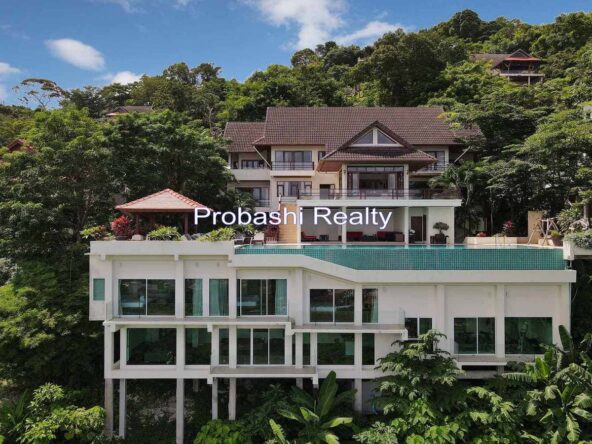

Villa Thai Sawan for sale in Patong, West district

- Beds: 8

- Baths: 9

- 8,073 Sq Ft

- USD $3,945,325