When it comes to foreign rules and regulations for buying or selling real estate in Australia, here are some key considerations that generally apply in all six (6) states: 1) New South Wales 2) Queensland 3) South Australia 4) Tasmania 5) Victoria and 6) Western Australia.

In Australia, the legal service process for foreign individuals and entities buying or selling real estate or businesses involves specific regulations in various legal services that must be considered, and these services generally apply in all states . Here are some key legal considerations:

1. Title Search and Due Diligence: It is essential to conduct a title search to verify ownership and assess any encumbrances or restrictions on the property.

2. Contract Review: Legal professionals can review and draft contracts to ensure they protect your interests and comply with local laws and regulations.

3. Conveyancing: Conveyancing / legal clerk or solicitors can manage the transfer of property, including preparing legal documents and coordinating settlements.

4. Property Inspections: Arrange building and pest inspections to identify any issues with the condition of the property.

5. Financial and tax advice: Seek financial and tax advice to understand the financial implications of the transaction, including stamp duty and capital gains tax.

6. Foreign Investment Rules: Foreign investors must comply with any restrictions or requirements related to real estate or business ownership in accordance with federal and state laws.

7. Real Estate: Foreigners can generally purchase new housing, but they generally cannot purchase existing residential properties. Investing in commercial real estate is more accessible to foreign buyers.

8. Business Ownership: Foreign investors can establish businesses in Australia, subject to regulations and certain restrictions based on the sector and size of the business. The process may involve various approvals and compliance with legal requirements.

9. Legal Representation: It is essential to engage local legal professionals to effectively navigate the legal process and ensure compliance with Australian laws and regulations.

10. Taxation: Tax considerations, including stamp duty and capital gains tax, may vary for overseas buyers and sellers, requiring careful consideration of potential tax implications.

These services are fundamental to a successful property transaction and apply consistently across all states and territories of Australia. Legal professionals, transportation and other experts can provide personalized advice based on specific state laws and regulations.

Here are the top 12 key points regarding current laws and regulations on foreign individuals buying or selling real estate in all six states of Australia:

-

Ownership Restrictions: Foreigners can usually buy new dwellings, but restrictions often apply to existing residential properties.

-

Commercial Real Estate: Commercial real estate is generally more accessible to foreign investors.

-

Legal Representation: Engaging local legal professionals is essential to navigate state-specific laws and regulations.

-

Due Diligence: Conduct thorough due diligence, including property inspections, title searches, and contract reviews.

-

Property Title: Verify property ownership and any encumbrances through a title search.

-

Contract Compliance: Ensure contracts comply with local laws and protect your interests.

-

Financial and Tax Advice: Seek advice on stamp duty, capital gains tax, and other financial implications.

-

Foreign Investment Rules: Comply with federal and state laws regarding property and business ownership.

-

Stamp Duty: Be aware of the varying rates of stamp duty by state for property purchases.

-

Legal Structure: Consider the legal structure for property ownership, such as joint ventures or trusts.

-

Visa Status: Visa type can affect property and business ownership for foreign individuals.

-

Licensing: Some states require licenses for specific property-related activities, such as real estate agency work.

These points provide an overview of the legal landscape for foreign buyers and investors in all six states of Australia, but it’s essential to seek region-specific legal advice and expertise for the most accurate guidance.

Available for Sale

Elegant 2-Bedroom Apartment for Sale Near Rajshahi Medical College Hospital

- BDT 87,00,000

- Beds: 2

- Baths: 3

- 1,445 Sq ft

- Apartment

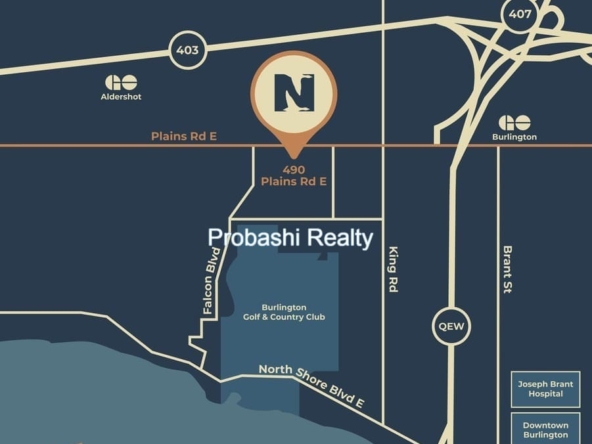

Northshore – Affordable Condo Living in Burlington

- CAD $499,990

- Beds: 1-3

- Nearly 1000 Sq Ft

- Condo

1,445 Sq Ft Apartment for Sale near Rajshahi Medical College

- BDT 87,00,000

- Beds: 2

- Baths: 3

- 1,445 Sq ft

- Apartment

The Humber Condos: Premier Toronto Residences for Sale

- CAD $801 per Sq Ft

- Beds: 1-3

- Baths: 2

- 451-1,129 sq ft

- Condo

Modern Townhouse Sale in Edmonton

- CAD $435,000

- Beds: 3

- Baths: 2.5

- 1,563 sq ft

- Townhouse

Modern Condo for Sale in the Heart of Downtown, Montreal

- CAD $469,000

- Beds: 2

- Bath: 1

- 456 Sq.ft

- Apartment, Condo