In France, foreign nationals are generally welcome to buy real estate and businesses. However, specific rules and regulations apply. When purchasing real estate, there are no restrictions for EU and EEA citizens. Non-EU/EEA nationals may require permission from the French authorities, and certain restrictions may apply in sensitive areas, such as near military installations. Additionally, real estate transactions in France typically involve a notary, who ensures the legality of the sale and protects both parties’ interests.

Regarding business ownership, foreign nationals can establish or buy businesses in France. The specific regulations and requirements may depend on the type of business and the individual’s nationality. Some businesses, particularly those in strategic sectors, may require authorization from the French government. Additionally, consulting with legal experts or business advisors well-versed in French commercial law is highly advisable to navigate the complexities of business ownership in France as a foreign national.

In France, the legal service process for foreign individuals and entities buying or selling real estate and businesses involves several key points:

Notarial Involvement: Transactions typically require notarial services to ensure legal compliance and handle the financial aspects.

1. Due Diligence: Thorough due diligence, including property inspections and title searches, is essential for understanding the property’s condition and legal status.

-

Preliminary Contracts: A preliminary contract (compromis de vente) is signed between the buyer and seller, outlining the sale terms and conditions.

-

Financial Obligations: Be prepared for various fees, including notary fees, registration taxes, and potential capital gains tax.

-

Legal Structure: Consider the appropriate legal structure for property or business ownership, especially for non-resident investors.

-

Residency Impact: Your residency status can affect tax obligations and potential exemptions.

-

Zoning and Restrictions: Familiarize yourself with local zoning regulations and potential property use restrictions.

-

Language: Legal documents are in French, so translation services may be needed.

-

Bank Financing: Non-residents may face challenges in securing financing from French banks.

-

Property Insurance: Adequate property insurance is important to protect your investment.

-

Employment Laws: Business investors should understand French labor laws and employment regulations.

-

Visa Requirements: Depending on your intentions, you may need to explore visa options for residing and working in France.

These points offer a broad overview of the legal landscape for foreign buyers and investors in France. Engaging local legal professionals with expertise in French real estate and business laws is crucial for a successful and legally compliant transaction. Foreign buyers and investors in France should seek legal advice and representation to navigate the legal service process effectively, ensuring compliance with French laws and regulations.

Available for Sale

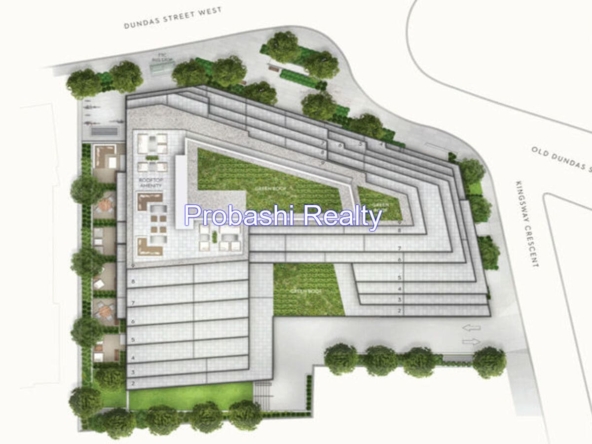

Kingsway Crescent Condos for sale in Toronto

- CAD $879,900

- Beds: 1-3

- Baths: 1-2

- 634-1,456 Sq Ft

- Condo

8 Elm Street Condos for sale in Toronto

- CAD $710,900

- Beds: 1-3

- Baths: 1-2

- 300-1,123 Sq Ft

- Condo

42 Mill St Condos for sale in Toronto

- CAD $1,304,990

- Beds: 1-2

- Baths: 1-2

- 1,157-1,470 Sq Ft

- Condo

1,620 Sq Ft apartment for sale in Mogbazar, Dhaka

- BDT 1.4 Crore

- Beds: 3

- Baths: 3

- 1,620 Sq Ft

- Apartment

Le Sherbrooke condo for sale in Montreal

- $548,316

- Beds: 1-2

- Baths: 1-2

- 341-1070 Sq Ft

- Condo