Latest real estate news around the Global

The global real estate market in Europe, Asia, Middle East and North America

Current Trends in the Global Real Estate Market: A Regional Overview

Europe: Navigating Diversity and Sustainability

The European real estate market continues to demonstrate its diversity, with each country presenting unique dynamics. Amidst the ongoing pandemic recovery, urban centers like London, Paris, and Berlin are witnessing a renewed interest in mixed-use developments, blending residential and commercial spaces. Sustainability is a key driver across the continent, with an increasing emphasis on energy-efficient buildings, green certifications, and eco-friendly urban planning. Additionally, the rise of remote work has led to a growing demand for suburban properties, as buyers seek more space and quieter surroundings. In Eastern European countries, growing tech industries are influencing real estate demand, as investors eye emerging tech hubs. Regulatory changes aimed at foreign investment and housing affordability are also influencing market trends, making Europe’s real estate landscape a mix of innovation, sustainability, and adaptability.

Asia: Tech Innovations and Urban Transformation

The Asian real estate market is characterized by rapid urbanization and technological innovation. Cities like Singapore and Tokyo are embracing smart city initiatives, incorporating tech-driven solutions into urban planning. Co-living spaces and flexible workspaces are becoming more popular, reflecting changing lifestyles and work patterns. China’s property market remains a focal point, with cities like Shanghai and Beijing experiencing continued growth, although policies aimed at cooling the property market are influencing investment strategies. In India, affordable housing initiatives are driving demand in urban and semi-urban areas. International investors are showing interest in Southeast Asian markets like Vietnam and Indonesia, drawn by growth potentials. Overall, Asia’s real estate trends are shaped by a blend of urbanization, technological advancements, and a quest for innovative living solutions.

North America: Urban Revival and Lifestyle Evolution

North America’s real estate market is marked by urban revival and lifestyle-centric choices. Major cities like New York, Los Angeles, and Toronto are witnessing a renewed focus on walkable neighborhoods, green spaces, and mixed-use developments. The pandemic has accelerated the trend of remote work, leading to a migration from urban centers to suburbs and smaller cities in search of more space and outdoor amenities. The U.S. housing market is grappling with supply shortages and rising home prices, driving competition among buyers. In Canada, efforts to cool the market and address housing affordability include measures like foreign buyers’ taxes and incentives for first-time homebuyers. Commercial real estate is evolving with the rise of e-commerce, leading to repurposing and redevelopment of retail spaces. North America’s real estate trends reflect a balance between urban appeal, lifestyle preferences, and adapting to the changing norms of work and living.

Middle East: Smart Cities, Technology and Tourism

The Middle East’s real estate market is undergoing significant shifts and adaptations driven by economic diversification, urbanization, and evolving market dynamics. Here are some current trends shaping the Middle East real estate landscape:

Sustainable Development: Sustainability has emerged as a key focus in the Middle East’s real estate sector. Governments and developers are increasingly incorporating green building practices, renewable energy sources, and environmentally friendly designs into their projects. This commitment to sustainability aligns with global efforts to combat climate change and create more livable cities.

Smart Cities and Technology: The Middle East is embracing the concept of smart cities, integrating technology to enhance urban living. Dubai’s Smart City initiative and Saudi Arabia’s Neom project exemplify this trend, leveraging innovations like IoT, data analytics, and AI to improve urban services, transportation, and overall quality of life.

Tourism and Hospitality: The region’s tourism sector is driving demand for hospitality and leisure real estate. Iconic developments, such as Qatar’s Lusail City and the Red Sea Project in Saudi Arabia, are designed to attract international tourists and promote sustainable tourism. These initiatives include luxury resorts, entertainment complexes, and cultural destinations.

Mixed-Use Developments: Mixed-use developments are gaining popularity, offering integrated spaces that combine residential, commercial, and retail components. These developments create vibrant communities where residents can live, work, and play without extensive commutes, aligning with the region’s growing urban population.

Affordable Housing: Some countries in the Middle East are prioritizing affordable housing solutions to cater to their growing populations. Governments are implementing policies and initiatives to increase the availability of affordable housing units, aiming to address housing shortages and improve accessibility for citizens.

Real Estate Regulations: Regulatory reforms are being introduced to stimulate investment, enhance market transparency, and protect investors’ rights. Changes in property ownership laws and foreign investment regulations are creating a more attractive environment for both local and international investors.

Diversification Beyond Oil: Economic diversification efforts are impacting real estate markets. Gulf countries are investing in sectors beyond oil, such as technology, finance, and tourism, which has a cascading effect on demand for office and residential spaces.

Infrastructure Development: Infrastructure projects, including transportation networks and cultural landmarks, are shaping real estate demand. The development of new airports, metro systems, and iconic attractions drives urban expansion and the need for adjacent real estate developments.

E-commerce and Logistics: The rise of e-commerce is driving demand for logistics and warehousing spaces. As online shopping becomes more prevalent, developers are investing in distribution centers and last-mile delivery solutions to meet changing consumer behaviors.

Real Estate Investment Trusts (REITs): The introduction of REITs in some Middle Eastern countries provides a new investment avenue for both retail and institutional investors, enabling them to access the real estate market without direct ownership.

The Middle East’s real estate market is evolving to meet the demands of a changing economy and society. Sustainable and tech-driven developments, coupled with efforts to diversify economies, position the region’s real estate market for continued growth and innovation.

Europe, Asia, Middle East, and North America collectively showcase the global real estate market’s diversity and resilience, responding to economic, technological, and social shifts. Each region’s unique trends reflect a blend of regional dynamics and global influences, making the global real estate landscape a dynamic and ever-evolving sector.

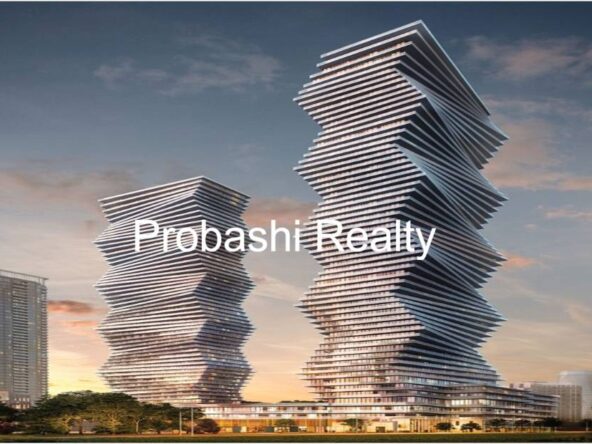

Available For Sale

Apartments for sale in Al safa residential complex in Dubai

- Beds: 2

- Bath: 1

- 952.92 Sq Ft

- AED 1,570, 000