Overview of the global real estate market in 2023

Overview of the global real estate market in 2023

The real estate market encompasses the earnings generated by entities involved in offering various services, such as renting residential and non-residential buildings, mini-warehouses, self-storage units, and property management. This sector includes players like builders, developers, real estate lessors, and property management firms. Activities such as property management, sales, rentals, purchases, and appraisals of real estate for clients are also part of this market. The market valuation takes into account the value of accompanying goods sold alongside the services. Only transactions between entities or with end consumers are considered.

Between 2022 and 2023, the global real estate market expanded from $3694.47 billion to $3976.18 billion, reflecting a compounded annual growth rate (CAGR) of 7.6%. The progress in global economic recovery from the COVID-19 pandemic was disrupted in the near term by the Russia-Ukraine conflict. This war prompted economic sanctions on several nations, elevated commodity prices, disruptions in supply chains, and an upsurge in inflation across goods and services, impacting various worldwide markets. Forecasts suggest that the real estate market is poised to reach $5209.84 billion by 2027, with a CAGR of 7.0%.

Asia Pacific was the largest region and North America was the second largest region in the real estate market

Asia Pacific was the largest region and North America was the second largest region in the real estate market

In 2022, the Asia-Pacific region held the dominant position in the real estate market, with North America following closely as the second-largest region within this sector. The geographical scope of the real estate market analysis encompasses Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa.

The real estate market report delves into a range of countries, including but not limited to Argentina, Australia, Austria, Belgium, Brazil, Canada, Chile, China, Colombia, the Czech Republic, Denmark, Egypt, Finland, France, Germany, Hong Kong, India, Indonesia, Ireland, Israel, Italy, Japan, Malaysia, Mexico, the Netherlands, New Zealand, Nigeria, Norway, Peru, the Philippines, Poland, Portugal, Romania, Russia, Saudi Arabia, Singapore, South Africa, South Korea, Spain, Sweden, Switzerland, Thailand, Turkey, the UAE, the UK, the USA, Venezuela, and Vietnam.

Pressures on the global economy persist

Pressures on the global economy persist

The challenges faced by the worldwide economy endured during the second quarter of 2023. The scenario was characterized by additional increments in interest rates, persistent high levels of inflation, and a gradual rebound in trade activities, all of which collectively added to the existing difficulties. Businesses and tenants are adopting a careful stance, extending the time taken to make decisions due to the prevailing uncertainties. Moreover, the escalating expense of capital and a prudent assessment of investment opportunities by investors are both contributing to a dampening effect on transactional activities within the market.

The International Monetary Fund (IMF) predicts about global GDP growth

The International Monetary Fund (IMF) predicts about global GDP growth

The expansion of the real estate market will receive a boost from the projection of consistent economic advancement in numerous developed and emerging nations. The International Monetary Fund (IMF) has put forth an estimate indicating that the worldwide growth of real Gross Domestic Product (GDP) is anticipated to stand at 3.7% spanning the years 2019 and 2020, followed by a 3.6% rate from 2021 through 2023. Moreover, the anticipated recovery of commodity prices, subsequent to a notable downturn in the historical phase, is poised to contribute further to the upswing in the market. Established economies are also on track to demonstrate steadfast expansion throughout the forecasted period. Notably, emerging markets are projected to maintain a marginally swifter pace of growth compared to their developed counterparts during the forecasted interval. For instance, as per authoritative figures sourced from the World Bank, India’s Gross Domestic Product (GDP) witnessed an ascent, reaching $3173.40 billion in 2021, in contrast to the $2667.69 billion recorded in 2020.

The real estate market is made up of earned income

The real estate market is made up of earned income

The real estate market comprises the earnings generated by entities engaged in delivering various services, including the leasing of residential and housing structures, the provision of non-residential property rentals, and the operation of mini-warehouses and self-storage unit rentals.

Real estate pertains to the intricate cycle of constructing, leasing, acquiring, and selling properties, encompassing both residential and commercial domains. Developers reap profits by enhancing land value through constructing buildings, making improvements, and obtaining rezoning permissions. Real estate agencies play a pivotal role in shepherding buyers through the intricate web of associated documentation and processes.

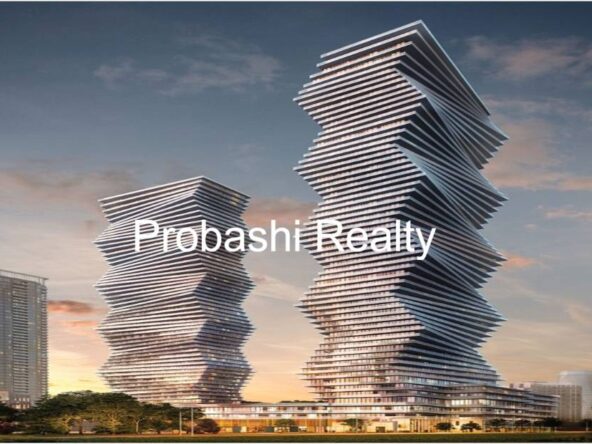

Available For Sale

Apartments for sale in Al safa residential complex in Dubai

- Beds: 2

- Bath: 1

- 952.92 Sq Ft

- AED 1,570, 000